Moral Turpitude Gambling

Question: What is a Crime of Moral Turpitude, and what offenses or arrests are considered Moral Turpitude?

The unit also works closely with state and federal agencies and local licensing/revenue departments to ensure compliance with laws dealing with alcohol. The Vice Unit is responsible for investigating crimes of moral turpitude including prostitution, gambling, obscenity, and solicitation. CRIMES OF MORAL TURPITUDE ' UNLICENSED DEALING IN FIREARMS Mayorga v. Attorney General U.S.F.3d , 2014 WL 2898528 (3d Cir. 27, 2014) (federal conviction of unlicensed business of firearms dealing, in violation of 18 U.S.C. 922(a)(1)(A) and (a)(2), did not categorically constitute a crime of moral turpitude, since the offense is a regulatory/licensing offense); see.

Answer: Moral turpitude is the terms for a legal idea meaning 'conduct that is considered contrary to community standards of justice, honesty or good morals.' The concept of moral turpitude can be used to identify or describe certain crimes that involve an 'act of baseness, vileness or depravity in the private and social duties which a man owes to his fellowmen, or to society in general, contrary to the accepted and customary rule of right and duty between man and man.'

Deferred Adjudication or disposition, with a plea of nolo contendre, may prevent the consequences by avoiding conviction.

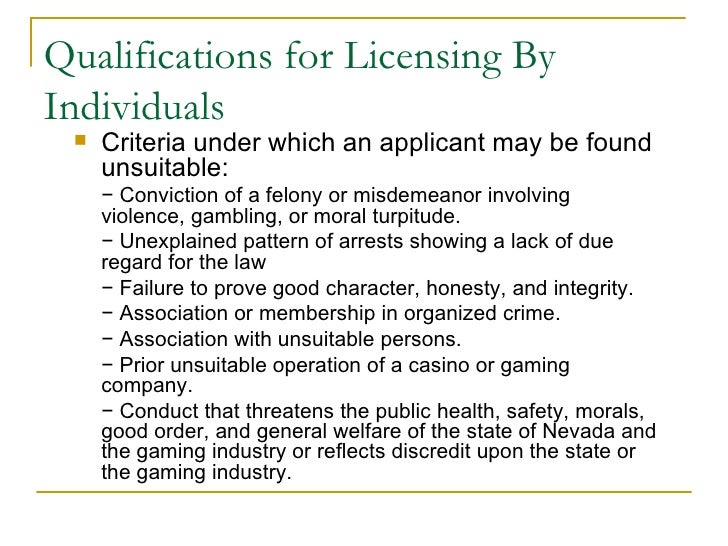

The specific crimes or arrests that are deemed Crimes of Moral Turpitude has significance in several areas of law, especially for those arrested for an offense considered a Crime of Moral Turpitude. First, prior conviction of a crime of moral turpitude (or in some jurisdictions, moral turpitude conduct, even without a conviction) is considered to have a bearing on the honesty of a person, especially if that person is a witness in other legal proceedings. A conviction (and in some areas, a mere arrest) may be grounds to deny or revoke a professional license such as a teaching credential, license to practice law, or other licensed profession that is regulated by the state or federal government. Lastly, it is of great importance for immigration purposes, as offenses defined as involving moral turpitude are considered bars toimmigration into the U.S.

According to the Texas Administrative Code, TITLE 22 EXAMINING BOARDS PART 22 TEXAS STATE BOARD OF PUBLIC ACCOUNTANCY, CHAPTER 519 PRACTICE AND PROCEDURE, SUBCHAPTER A GENERAL PROVISIONS RULE §519.7 Misdemeanors that Subject a Certificate or Registration Holder to Discipline by the Board:

(a) Final conviction or placement on deferred adjudication, deferred prosecution, withheld adjudication or community supervision in connection with misdemeanors that involve dishonesty or fraud may subject a certificate or registration holder to disciplinary action pursuant to §501.90 of this title (relating to Discreditable Acts). Because a certificate or registration holder is often placed in a position of trust with respect to client funds, and the public in general, and the business community in particular, rely on the veracity, integrity and honesty of certificate or registration holders in the preparation of reports and provision of other accounting services, the board considers conviction or placement on deferred adjudication, deferred prosecution, withheld adjudication or community supervision for any crime involving dishonesty or fraud to relate directly to the practice of public accountancy and may subject the certificate or registration holder to discipline by the board.

The board has determined that misdemeanor offenses that involve dishonesty or fraud directly relate to the practice of accounting pursuant to Sections 53.021, 53.022, 53.023 and 53.025 of the Occupations Code.

The following non-exclusive list of misdemeanor offenses may involve dishonesty or fraud:

(1) Theft; (2) Theft of Service; (3) Tampering with Identification Numbers; (4) Theft of or Tampering with Multichannel Video or Information Services; (5) Manufacture, Distribution, or Advertisement of Multichannel Video or Information Services Device; (6) Sale or Lease of Multichannel Video or Information Services Device; (7) Possession, Manufacture, or Distribution of Certain Instruments Used to Commit Retail Theft; (8) Forgery; (9) Criminal Simulation; (10) Trademark Counterfeiting; (11) Stealing or Receiving Stolen Check or Similar Sight Order; (12) False Statement to Obtain Property or Credit; (13) Hindering Secured Creditors; (14) Credit Card Transaction Record Laundering; (15) Issuance of Bad Check; (16) Deceptive Business Practices; (17) Rigging Publicly Exhibited Contest; (18) Misapplication of Fiduciary Property or Property of Financial Institution; (19) Securing Execution of Document by Deception; (20) Fraudulent Destruction, Removal, or Concealment of Writing; (21) Simulating Legal Process; (22) Refusal to Execute Release of Fraudulent Lien or Claim; (23) Breach of Computer Security; (24) Unauthorized Use of Telecommunications Service; (25) Theft of Telecommunications Service; (26) Publication of Telecommunications Access Device; (27) Insurance Fraud; (28) False Alarm or Report; (29) Engaging in Organized Criminal Activity; (30) Violation of Court Order Enjoining Organized Criminal Activity; (31) Unlawful Use of Criminal Instrument; (32) Unlawful Access to Stored Communications; (33) Burglary of Vehicles; (34) Burglary of Coin-Operated or Coin Collection Machines; (35) Coercion of Public Servant or Voter; (36) Improper Influence; (37) Gift to Public Servant by Person Subject to His Jurisdiction; (38) Offering Gift to Public Servant; (39) Perjury; (40) False Report to Peace Officer or Law Enforcement Employee; (41) Tampering With or Fabricating Physical Evidence; (42) Tampering With Governmental Record; (43) Fraudulent Filing of Financing Statement; (44) False Identification as Peace Officer; (45) Misrepresentation of Property;

*Keep in mind that Texas State Case Law has a profound effect on determinations of Law, Licensing, and CMT.

Find out more:

- ** Visit our Main Website**

Additional resources provided by the author

Rate this guide

About the author

Moral Turpitude Gambling Meaning

In re Calaway , 20 Cal.3d 165

Moral Turpitude Gambling Laws

In re MARTIN C. CALAWAY on Disbarment

(Opinion by The Court.) [20 Cal.3d 166]

COUNSEL

Donald B. Caffray for Petitioner.

Herbert M. Rosenthal for Respondent.

OPINION

THE COURT.

This is a proceeding to review a recommendation of the Disciplinary Board of the State Bar of California that petitioner be disbarred. Petitioner, who was admitted to the practice of law in 1956, was convicted in federal district court of violating 18 United States Code section 1955 (conducting, financing, managing, supervising, directing or owning an illegal gambling business) and 18 United States Code section 371 (conspiring to violate § 1955). The conviction was affirmed on appeal and is now final. (Although petitioner has applied for a writ of habeas corpus in federal court, based on alleged incompetence of trial counsel, the pendency of this petition does not affect the finality of his conviction.) On May 1, 1975, we referred the matter of petitioner's conviction to the State Bar for hearing, report, and recommendation on the question whether the facts and circumstances surrounding the commission of the offenses involved moral turpitude or other misconduct [20 Cal.3d 168] warranting disciplinary action. (See Bus. & Prof. Code, §§ 6101, 6102; Cal. Rules of Court, rule 951(c), (d).)

A local administrative committee, following a hearing, found that petitioner 'was actively involved in the criminal conspiracy of which he was convicted, such activity including financing, managing, counselling, and supervising an illegal gambling operation.' The committee further found that petitioner 'willfully and knowingly' engaged in the conspiracy and illegal gambling operation; that he made his legal services available to further the conspiracy and to counsel and protect his coconspirators; that he assisted in locating customers for the game and ultimately received some of the proceeds thereof; and that he improperly used conservatorship funds to finance the operation. The committee concluded that the offenses of which petitioner was convicted involved conscious and willful acts of moral turpitude on petitioner's part, and recommended that he be disbarred.

The disciplinary board voted to approve and adopt substantially all of the committee's findings and also specifically found that the facts and circumstances surrounding petitioner's offenses involved moral turpitude. The board, by a vote of nine to four, recommended that petitioner be disbarred. (The dissenters would have recommended less severe punishment.) [1a] Petitioner now contends that the record fails to support the findings of fact, that the offenses at issue did not involve moral turpitude, and that the recommended discipline is excessive.

The record discloses that petitioner and his coconspirators were involved with an unlawful gambling operation in the San Fernando Valley. Although petitioner denied (and continues to deny) his knowledge of, or participation in, the illegal conspiracy, the federal court convicted him of both the substantive offense of illegal gambling as well as conspiring to commit that offense. A review of the record in the federal case discloses sufficient evidence from which the following facts reasonably may be inferred: Petitioner participated in the preliminary discussions between the coconspirators which ultimately led to the formation of the unlawful gambling operation. Among other things, the parties discussed during these meetings the financial contributions which each would make, and their respective shares of the proceeds. Petitioner was to contribute $20,000 as his share, consisting of $10,000 in cash and $10,000 in legal services; in return for his contribution, petitioner would receive from 20 to 25 percent of the 'take.' [20 Cal.3d 169]

Petitioner, with knowledge of coconspirator John Vaccaro's status as a professional gambler and his intent to set up an unlawful gambling operation, loaned $7,500 to him, at least $2,500 of which was actually used to fund the game. Petitioner ultimately invested $5,000 and received in return some of the proceeds from the illegal gambling. Petitioner gave nonlegal advice to the coconspirators regarding the practical aspects of their illicit endeavors, including the obtaining of gambling equipment, chips, and customers to frequent the new establishment, and the purchase of 'sanction' or protection from the police. Petitioner also gave legal advice to the coconspirators regarding the illegal nature of the proposed operation and the necessity of concealing its activities.

The dice and card games operated by petitioner's coconspirators were 'rigged' to cheat the customers and increase 'house' profits. From petitioner's close association with coconspirator Vaccaro, and his financial interest in the operation, it may reasonably be inferred that petitioner was aware that such cheating of customers occurred.

In addition to the foregoing, the record indicates that the $7,500 loan from petitioner to Vaccaro came from funds held by petitioner as conservator of the estate of an 86-year-old incompetent; that these funds were disbursed without the knowledge or approval either of the conservatee or of the court with jurisdiction over his affairs; that the loan was not disclosed by petitioner's subsequent accountings; and that the loan was not fully repaid until after the federal prosecution had commenced.

Petitioner contends that the offenses of which he was convicted did not involve moral turpitude. [2] Although petitioner has the burden of showing that the board's finding of moral turpitude is not supported by the evidence, the question of moral turpitude itself is one of law, ultimately to be decided by this court. (In re Hurwitz (1976) 17 Cal.3d 562, 567 [131 Cal.Rptr. 402, 551 P.2d 1234].) In this regard, it is our duty to examine independently the record, reweigh the evidence and pass on its sufficiency. (Ibid.)

[1b] Our independent review of the record convinces us that petitioner committed acts involving moral turpitude. [3] As we have stated on many occasions, moral turpitude has been defined as 'an act of baseness, vileness or depravity in the private and social duties which a man owes to his fellowmen, or to society in general, contrary to the [20 Cal.3d 170] accepted and customary rule of right and duty between man and man.' (In re Fahey (1973) 8 Cal.3d 842, 849 [106 Cal.Rptr. 313, 505 P.2d 1369, 63 A.L.R.3d 465], quoting from an earlier case.) ''The concept of moral turpitude depends upon the state of public morals, and may vary according to the community or the times,' [citation] as well as on the degree of public harm produced by the act in question.' [Citation.] The paramount purpose of the 'moral turpitude' standard is not to punish practitioners but to protect the public, the courts and the profession against unsuitable practitioners. [Citations.]' (Ibid.)

[1c] In the present case, we may reasonably infer from the record that petitioner was deeply involved in an illegal gambling conspiracy which had as its purpose the acquisition of profits by cheating its customers. Petitioner disputes the premise that illegal gambling itself involves moral turpitude. He argues that '[g]ambling is a crime in California because of a statute, and not because of some fundamental evil about it that makes it a crime everywhere.' To the contrary, petitioner overlooks the fact that he has been convicted of committing, and conspiring to commit, a federal offense aimed at curtailing syndicated gambling: 'The intent of ... section 1955 [of title 18 U.S.C.] ... is not to bring all illegal gambling activity within the control of the Federal Government, but to deal only with illegal gambling activities of major proportions. ... It is intended to reach only those persons who prey systematically upon our citizens and whose syndicated operations are so continuous and so substantial as to be of national concern ....' (Italics added, United States v. Sacco (9th Cir. 1974) 491 F.2d 995, 1009 [conc. opn. by Hufstedler, J. quoting from a legislative report].) Petitioner's attempt to minimize the seriousness of his conduct fails when the foregoing congressional purpose is considered.

Petitioner points out that he was not found to have participated, personally, in any actual cheating at gambling. Nonetheless, he conspired with other persons who performed such acts, and the record supports a finding that petitioner knew of the cheating activities and encouraged such acts by his own participation, advice, and financial support. We conclude that there is ample evidence to sustain the board's finding that petitioner's acts involved moral turpitude.

Petitioner next contends that the recommended disbarment is excessive punishment for his offenses. [4] While it is our ultimate responsibility to determine the degree of discipline to be imposed, the board's recommendation is given great weight and petitioner has the burden of [20 Cal.3d 171] demonstrating that the recommendation is erroneous or unlawful. (In re Duggan (1976) 17 Cal.3d 416, 423 [130 Cal.Rptr. 715, 551 P.2d 19].) [1d] Our independent examination of the record discloses that petitioner committed acts involving moral turpitude and dishonesty and that the protection of the courts and the integrity of the legal profession require that he be disbarred. The record contains no evidence of petitioner's rehabilitation or remorse; he continues to dispute the seriousness of the offenses of which he was convicted. (See In re Hurwitz, supra, 17 Cal.3d 562, 568.) In addition, as the local committee found, petitioner 'improperly and unlawfully utilized conservatorship funds for the financing of [the] conspiracy,' conduct which by itself would warrant severe punishment. (See Sturr v. State Bar (1959) 52 Cal.2d 125, 134 [338 P.2d 897]; Clark v. State Bar (1952) 39 Cal.2d 161, 166-174 [246 P.2d 1]; Laney v. State Bar (1936) 7 Cal.2d 419, 422-423 [60 P.2d 845].)

It is ordered that petitioner be disbarred from the practice of law in this state and that his name be stricken from the roll of attorneys. It is further ordered that petitioner comply with rule 955 of the California Rules of Court and that he perform the acts specified in subdivisions (a) and (c) of that rule within 30 and 40 days, respectively, after the effective date of this opinion. This order is effective 30 days after the filing of this opinion.

Opinion Information| Date: | Citation: | Category: | Status: |

| Wed, 11/16/1977 | 20 Cal.3d 165 | Review - Criminal Appeal | Opinion issued |

Moral Turpitude Gambling Law

| 1 | MARTIN C. CALAWAY(Petitioner) |

| Disposition | |

| Nov 16 1977 | Guilty |